child tax credit september 2021 direct deposit

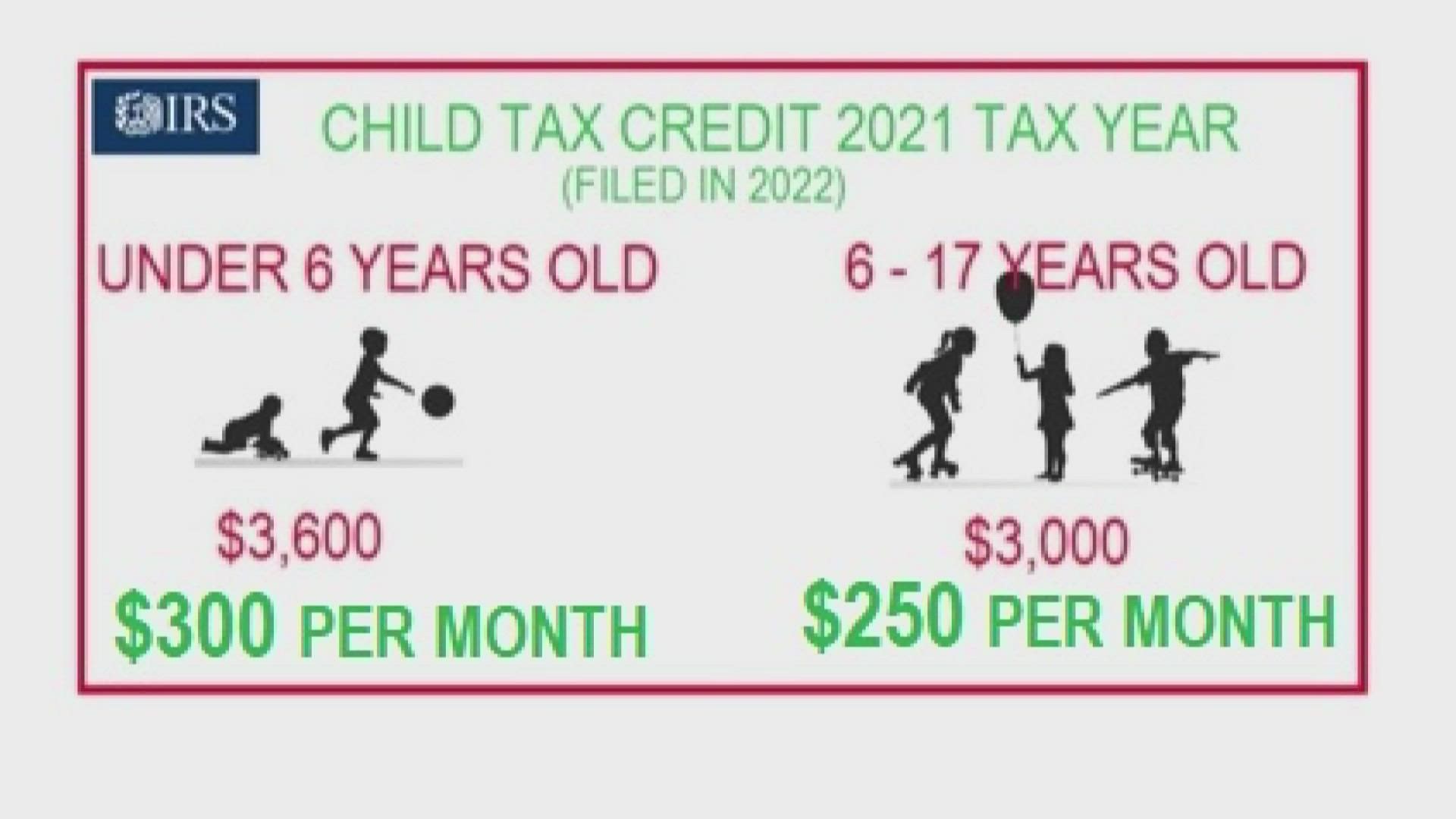

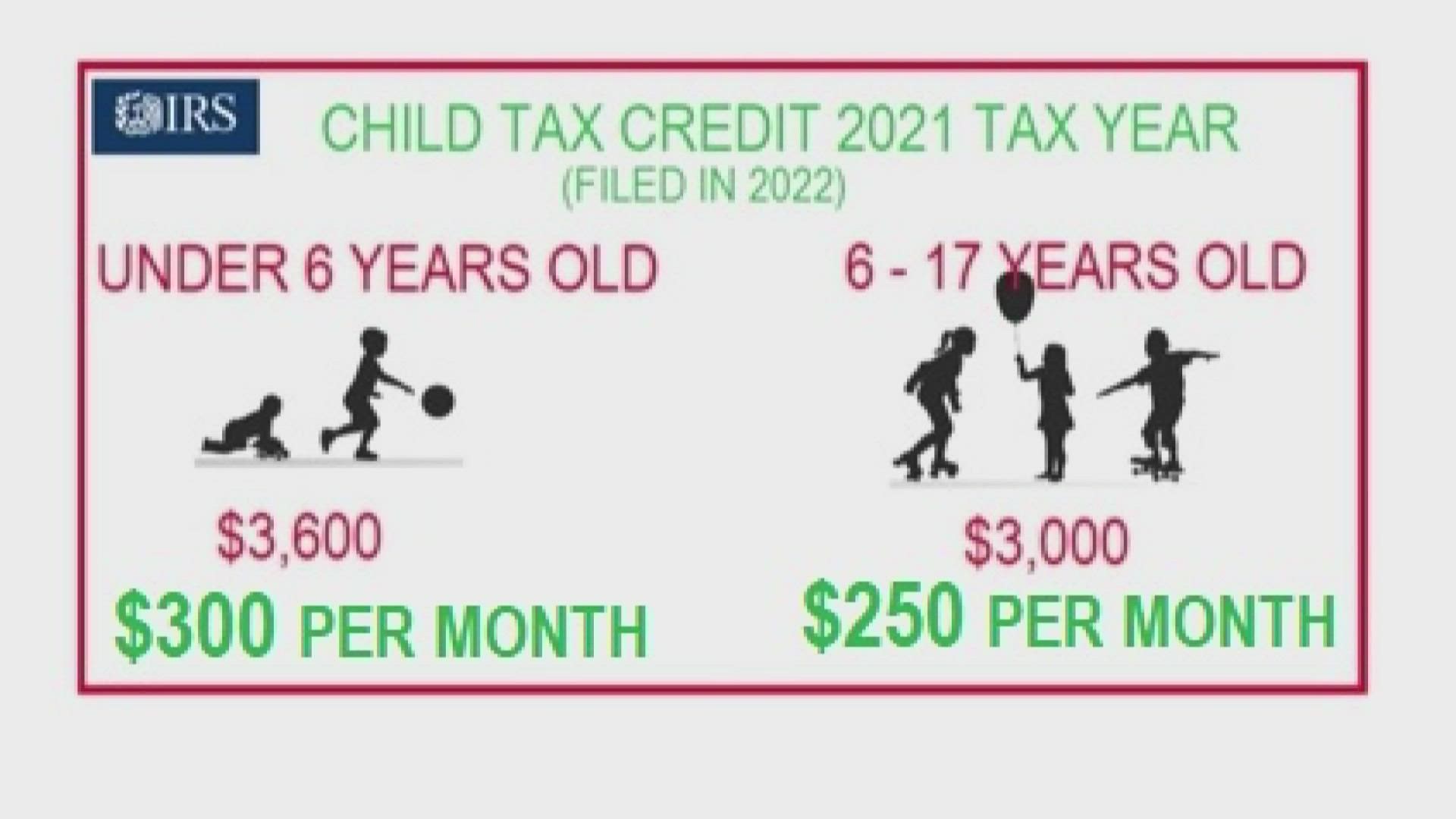

2020 and 2021 CTC before ARPA stimulus bill increase The Child Tax Credit CTC was set to 2000 per child for 2021 before Biden Stimulus bill ARPA update the same level as it was in 2020 and is available to taxpayers who have children aged under 17 at the end of the tax year. For 2021 a legal dependent who is age 17 or younger as of December 31 2021 can qualify for the child tax credit.

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

If you filed a 2020 or 2019 federal income tax return then you will get half your credit in six monthly payments.

. You will get half of this money in 2021 as an advance payment and half in 2022 when you file a tax return. This is the first year that 17-year-olds qualify for the CTC the previous age limit was 16. These payments should start on July 15 2021.

By Christine Tran 2021 Get It Back Campaign Intern. You can claim the. September 14 2021.

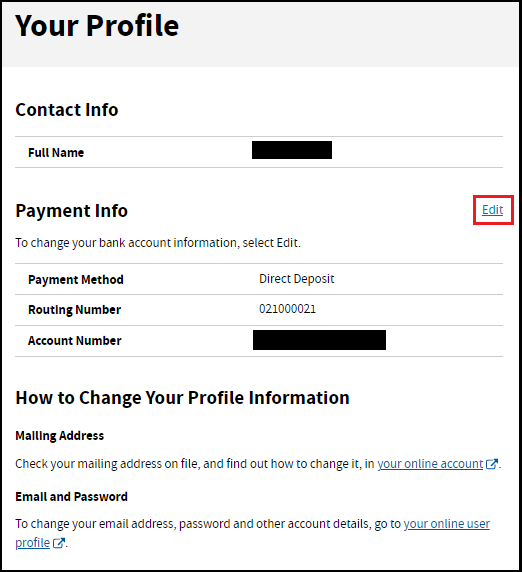

If the payment is sent by direct deposit. Taxpayers can claim the CTC Child Tax Credit for every child who qualifies with. Line 16 2021 Estimated Tax.

Attach all credit forms schedules or statements and Schedule P 100 or 541 if applicable to Form 109. Children also must have a Social Security number SSN to qualify for the 2021 child tax credit. What is the new Advance Child Tax Credit payment.

The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start. September 14 2021. You will get the other half when you file your 2021 tax.

Because of a recent law more families qualify for and will get money from the Child Tax Credit CTC even those that dont have recent income. If an eligible individual received advance Child Tax Credit payments through direct deposit to their bank account. Bank Account direct.

Instead of calling it may be faster to check the. A guide for divorced unmarried separated and non-custodial parents and guardians on all things Child Tax Credit and advance payments. 4 weeks if the payment was mailed by check to a standard address.

The new advance Child Tax Credit payment is money from the IRS for eligible families with children. Line 17 Withholding Form 592-B. You could get up to 3600 per child.

Because these credits were paid in advance every dollar received by an individual in 2021 will reduce the amount of Child Tax Credit that the individual can claim on their 2021 tax return. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Enter the total from Form 109 Side 3 Schedule B Tax Credits line 4.

The current tax season has been as bumpy as the last with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch-up payments for stimulus checks RRC and advance child tax credit payments. This means that by accepting advance Child Tax Credit payments the amount of an individuals refund may be reduced or the amount of tax that they owe may. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic E.

Enter the total amount of estimated tax payments made during the 2021 taxable year on this line.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

Child Tax Credit Info For Foster Parents Fpaws

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Where Is My September Child Tax Credit 13newsnow Com

Child Tax Credit Portal Get Your Direct Deposit Gobankingrates

December Child Tax Credit What To Do If It Doesn T Show Up Abc10 Com

Child Tax Credit Dates 2021 Latest August 30 Deadline To Opt Out Of September Payments As Parents Flock To Irs Portal

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

New Child Tax Credit Monthly Advance Payments

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tv Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back